The Monero Moon (Issue 78)

The Monero Moon is a curated newsletter covering all the latest news within Monero (XMR). We are driven by a compelling need to champion both freedom and financial privacy!

Table of Contents:

Development, Releases, and Technology

General News

Events and Meetings

Exchanges and Merchants

Community Crowdfunding

Trading and Speculation

Network Metrics

Entertainment

Development, Releases, and Technology

Monero v0.18.4.0 “Fluorine Fermi” is now live, with updated CLI and GUI binaries available for download. This is a recommended release that addresses multiple daemon-related vulnerabilities, including a remote P2P crash bug and a potential data leak from --anonymous-inbound. Wallet improvements include background sync using only the view key and a fix for restore-related sync issues. GUI updates bring smoother wallet creation, better testnet support, and bundled P2Pool v4.4. The update saw 164 commits across both codebases, with contributions from over 20 developers. Full release notes and hash verification steps are available on Getmonero.org.

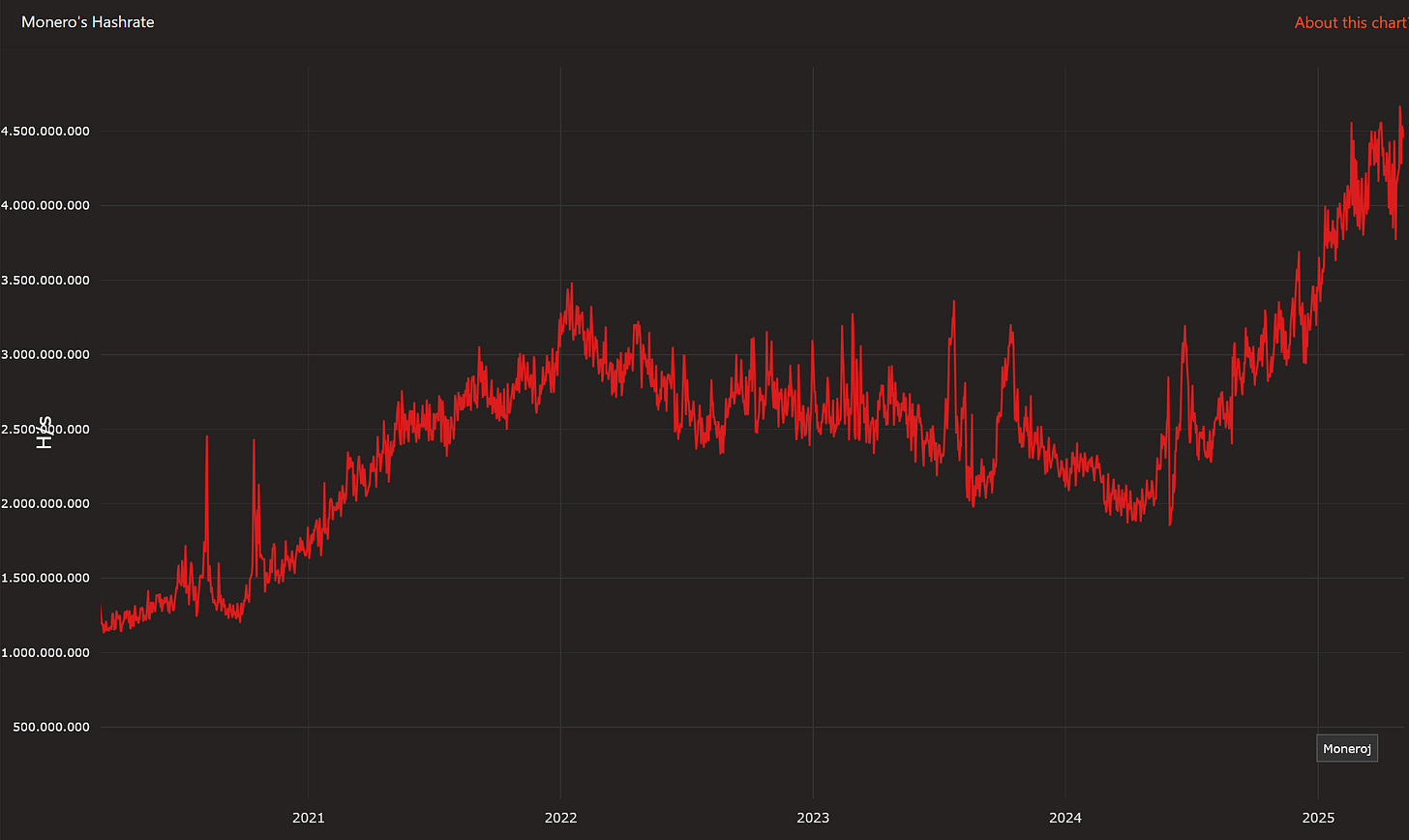

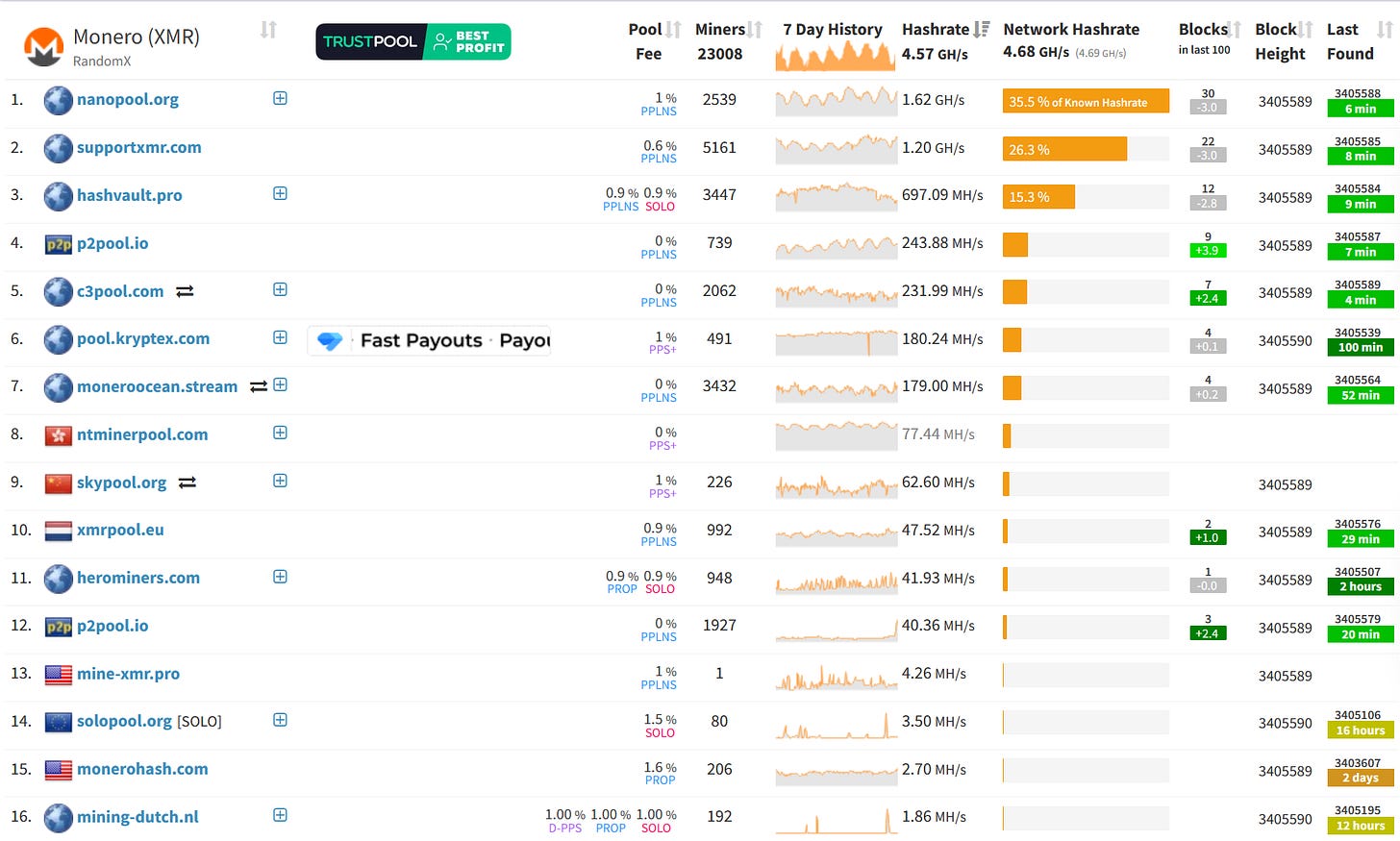

Monero's network hashrate recently reached a sustained all-time high. This milestone reflects a significant increase in mining participation and computational power dedicated to the Monero network for approximately twelve months. As of early May 2025, the hashrate remains robust, hovering around ~4.5 Ghash/s.

selsta has shared their Monero CCS progress report for April 2025, completing the second milestone of their part-time development proposal. Highlights include the successful release of v0.18.4.0, work on a vulnerability report, and early preparation for a future v0.19.0.0 release without a hard fork. You can read the progress update for more details.

j-berman has completed his latest CCS proposal after logging 646 hours of full-time work on Monero and FCMP++ development. In his final update, j-berman detailed progress on cold/hot wallet integration, fee logic for FCMP++, and a work-in-progress pull request for caching blinds in the background. He also helped launch the FCMP++ optimization competition (see below), aimed at further refining performance. The work builds on previous contributions and marks the conclusion of his ninth funded development round via the Community Crowdfunding System.

j-berman has officially launched the FCMP++ Optimization Competition, inviting contributors to improve two key cryptographic libraries powering Monero’s proposed FCMP++ upgrade: helioselene and ec-divisors. The contest offers 100 XMR for the best helioselene submission and 250 XMR for the top ec-divisors optimization, paid from the Monero General Fund. Submissions open April 28 and close June 30. Optimizing these libraries could significantly improve wallet sync, daemon performance, and transaction construction. Anonymous participation is allowed, and all details are available via the official contest announcement.

SChernykh has released P2Pool v4.5, bringing several bugfixes and useful improvements to the decentralized Monero mining protocol. Highlights include safer memory handling, crash fixes for RISC-V systems, and new debugging features like named threads. The update also improves startup reliability by allowing automatic fallback to a different host if the first is unavailable. Check out the release notes for full details and visit p2pool.io for setup help, mining guides, and donation info.

Haveno v1.1.1 has been released by woodser, bringing several improvements to trade completion. The update includes fixes for rare payment confirmation hangs, better shutdown handling for seed nodes, and improved compatibility with miner fee discrepancies across Monero versions. It also allows peers to re-confirm payment receipt with updated multisig states. You can view the full changelog here. To try Haveno on Monero mainnet, use a third-party Haveno network such as RetoSwap.

Rogue One highlighted that Monero’s liquidity on Haveno’s Retoswap DEX recently hit an all-time high, surpassing 5,550 XMR—valued at over $1.3 million USD—across 222 offers. This milestone highlights the growing adoption of decentralized, peer-to-peer trading solutions built around Monero, especially in the face of increasing regulatory pressure on privacy coins.

woodser has released haveno-ts v0.0.34, the latest version of Haveno’s TypeScript library. The update includes several improvements and fixes, such as updated tests for paysafe and offer info, increased peer notice timeout, and a higher max connection limit for Docker Compose setups. You can view the full changelog here. Note that v0.0.35 was released shortly after, with additional refinements.

atsamd21 has begun developing a standalone Haveno mobile app for Android, built from scratch using .NET MAUI Blazor. The app is currently functional for basic trades on the public stagenet and does not require a remote node, though support for one is planned. According to a recent post, iOS and desktop versions should follow based on community interest.

tobtoht has released Feather Wallet v2.8.1, featuring various bug fixes and component upgrades. The update addresses a Windows startup crash, raises the minimum macOS version to 12, and improves Flatpak compatibility with host cursor themes. Several components were also updated: Qt to v6.9.0, Tor to v0.4.8.16, and OpenSSL to v3.5.0.

acx has published the first progress report for their CCS proposal to maintain and develop Monfluo, an Android wallet for Monero. Highlights include the release of Monfluo v0.7.0 and the setup of F-Droid repositories for both clearnet and onion access. A full list of commits is available on Codeberg.

Cake Wallet v4.27.0 is now available featuring major improvements to background sync, new payment notifications, and various UI/UX enhancements. The update also includes bug fixes and improvements to WalletConnect functionality. A new version of Monero.com—Cake Labs’ Monero-only wallet—was released alongside the multi-coin Cake Wallet update. Both wallets are available on GitHub, and users can help test by joining the Cake Wallet beta program. A blog post with more details was also published on the Cake website following the release. It’s worth noting Cake Wallet has also rebranded, complete with a new logo and website.

rehrar has released Stack Wallet v2.1.11, bringing new features and under-the-hood improvements. The update adds support for Xelis, better logging, updated Epic Cash integration, and functionality for managing Namecoin names. Users can now paste payment URIs directly into the send field, and the wallet has been updated to the latest Flutter framework.

Tech1k has released a new self-hosted dashboard tool for Monero nodes, offering a clean and simple interface to display node and network data via RPC. The multi-network dashboard is easy to set up, supports contributions, and provides a live demo. You can visit tech1k.com to support the developer. As always, users are encouraged to inspect the code before running the script.

hinto-janai has published their first progress report for the ongoing CCS proposal to work full-time on Cuprate and FCMP++ reviews. The update includes 232 logged hours, two tagged releases (v0.0.1 and v0.0.2), a user book, and multiple merged PRs. While FCMP++ work has yet to ramp up, hinto-janai noted plans to assist once ready. A full list of contributions is available on GitHub, and more context can be found on the Monero Observer.

Monero Observer has published a new Monero Dev Activity Report to provide a big-picture view of Monero's development activity throughout the past week. If you’re interested in the nitty gritty, check it out here.

Tari, a new Layer-1 blockchain co-founded by former Monero maintainer Riccardo “fluffypony” Spagni, officially launched its mainnet today. Built in Rust, Tari is merge mined with Monero, allowing miners to secure both networks simultaneously. You can find out more about Tari here.

General News

Monero just celebrated its 11th birthday, marking over a decade of privacy-preserving digital currency. Despite a year of regulatory crackdowns and exchange delistings, the community pushed forward with protocol research, new merchant integrations, and a sharp rebound in price. Highlights from the past 12 months include the shutdown of LocalMonero, Kraken’s Europe XMR delistings, public Haveno networks going live, and the release of Monero v0.18.4.0 'Fluorine Fermi'.

Monero (XMR) recently surged to $329, its highest price since August 2021, following a sharp 40% rally. The spike coincides with what on-chain investigator ZachXBT claims was a massive theft of 3,520 BTC (worth around $330 million) from an elderly U.S. investor, reportedly the result of a sophisticated social engineering attack. The stolen Bitcoin was allegedly laundered through multiple exchanges and swapped into Monero, contributing to the sudden spike in XMR volume and price due to its limited liquidity. However, others in the crypto community speculate that broader privacy adoption, short squeezes, or coordinated accumulation may also be behind the move.

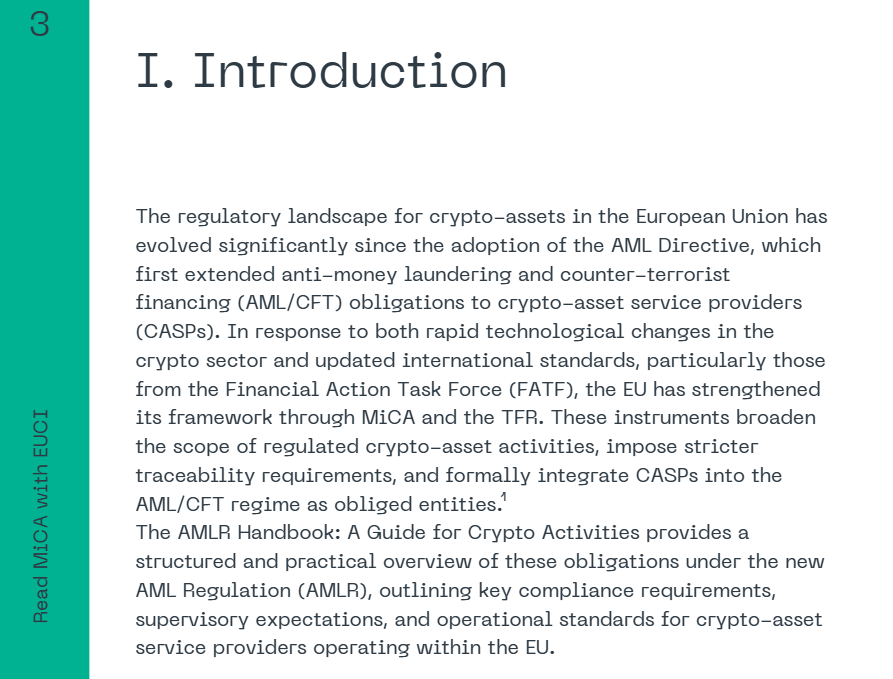

The European Union has finalized sweeping anti-money laundering (AML) regulations that will ban anonymous crypto accounts and privacy coins like Monero starting in 2027. The law targets crypto service providers, mandating customer due diligence for any transaction over €1,000 and prohibiting the use of privacy-enhancing technologies. However, enforcement against decentralized protocols such as Monero remains a major challenge. With no central authority or issuing body, Monero’s resilient design makes it inherently resistant to top-down restrictions.

In addition to this, France has passed new legislation introducing a presumption of money laundering for crypto transactions that involve anonymity-enhancing technologies, targeting platforms like Tornado Cash and privacy coins such as Monero. While not an outright ban, this marks one of the most aggressive legal approaches to financial privacy in Europe, aligning with FATF guidelines. The move raises enforcement questions, as Monero’s decentralized architecture and absence of a central issuer make restrictions difficult to apply in practice. Despite similar pressure elsewhere, Monero has continued to grow in adoption, hashrate, and real-world usage.

Rather than eliminating privacy coins, the regulation may accelerate innovation and decentralization, reinforcing Monero’s role as a censorship-resistant financial tool in an increasingly surveilled environment. Monero has already proven its strength in the face of similar moves: despite being delisted from major exchanges like Binance and Kraken in several jurisdictions, Monero’s price has continued to climb, and its network hashrate recently hit all-time highs, signaling sustained miner confidence and demand. As centralized platforms fold under regulatory pressure, peer-to-peer trading, self-hosted wallets, and DEXs like Haveno are gaining momentum, making Monero harder to stop, not easier.

To add to the complexity, the Monero Policy Working Group (MPWG) recently published a detailed blog exploring how the EU’s Markets in Crypto-Assets Regulation (MiCAR) addresses decentralisation—an issue with significant legal consequences for tools like Monero-aligned DEXs and multisig services. While MiCAR exempts “fully decentralised” offerings from regulation, it offers no concrete definition of what that means. This leaves even projects with no central issuer exposed to regulatory scrutiny if any part of their operations is interpreted as coordinated or intermediated. A recent report by ESMA and the EBA provided little clarity, while Denmark’s Finanstilsynet has proposed its own framework to assess decentralisation based on the presence of a controlling legal entity. The MPWG encourages crypto projects to remain open-source, permissionless, and community-driven—removing profit motives and centralized control wherever possible. Though proving full decentralisation may be difficult, it's a crucial goal in navigating the uncertain regulatory landscape.

Bitrace’s 2025 Crypto Crime Report reveals that over $649 billion in stablecoins flowed into high-risk addresses in 2024, including $52.5B tied to fraud and $86.3B to money laundering. Centralized issuers like Tether and Circle froze more than $1.3 billion in tokens last year alone, underscoring the heavy surveillance and compliance risks inherent to traceable assets. In stark contrast, Monero remains resistant to such control. With no centralized issuer and default privacy, Monero’s design inherently protects users from blacklists, seizures, and surveillance, offering censorship-resistant utility in a tightening regulatory climate.

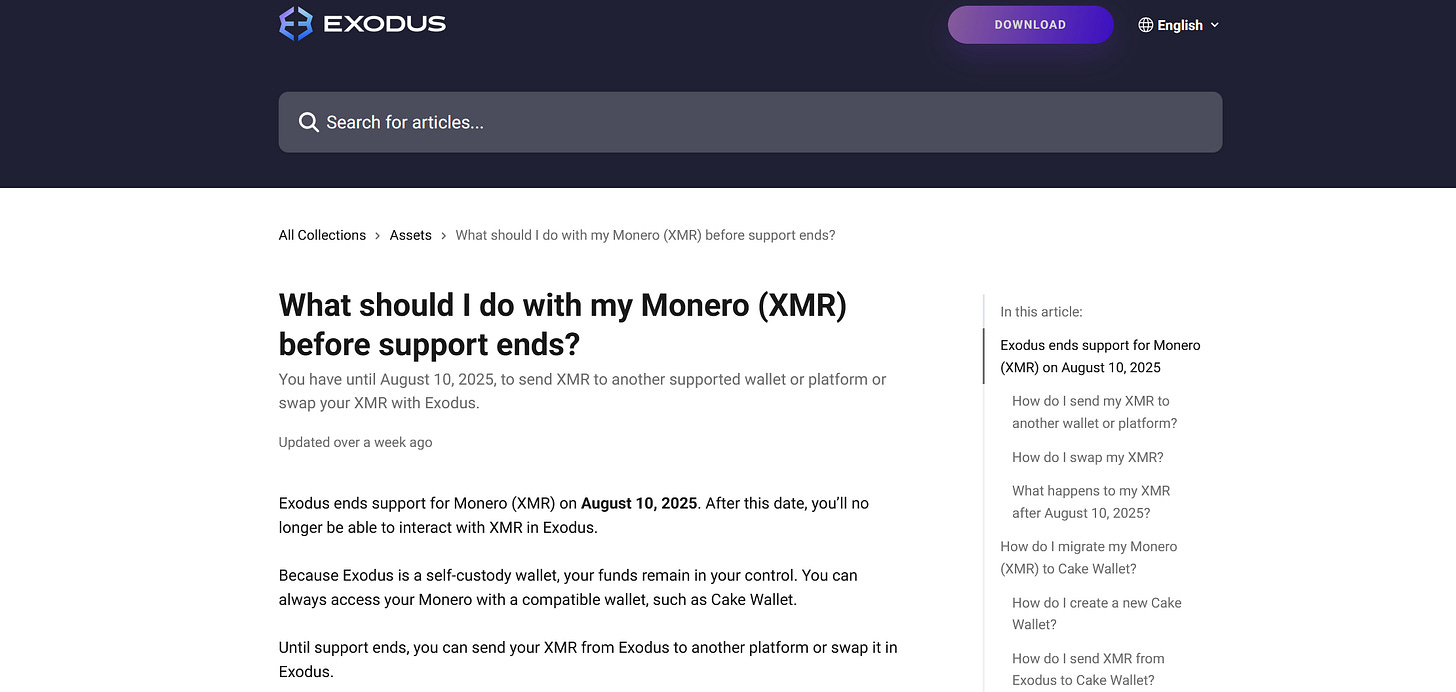

Exodus has announced it will end support for Monero (XMR) on August 10, 2025, citing a shift in strategic focus. After this date, users will no longer be able to send, receive, or view XMR balances within the wallet. Exodus recommends exporting your 25-word Monero seed to a compatible wallet before the deadline. More information can be found here.

MoneroTopia Episode 213 streamed live on May 3, 2025, bringing over four hours of Monero-centric content, market insight, and community discussion. The show featured a price report from Bawdyanarchist, news highlights with Tony, and special guests including Crypto Sowle and Zano. Check it out here.

Revuo Monero Issue #236 has been published. Check it out for a weekly dose of Monero news.

Events and Meetings

MoneroKon 2025 is coming to Prague on June 20–22! Join privacy advocates, developers, researchers, and enthusiasts from around the world for three days of talks, workshops, and community building—all focused on digital freedom and financial privacy. Tickets are available now.

The next MoneroKon 2025 Planning Meeting is scheduled for Saturday, May 10, 2025, at 17:00 UTC in the #monerokon Matrix/IRC channels. The agenda will be available on agenda.monerokon.org, and logs from the previous meeting can be found on Monero Observer. A CCS proposal to help fund the event was also recently fully funded.

Douglas Tuman has announced that MoneroTopia 2025 will take place at Porcfest in Lancaster, New Hampshire this June. Held during one of the largest liberty gatherings in the U.S., MoneroTopia will feature a dedicated tent with talks, panels, and workshops focused on privacy, freedom tech, and opt-out tools beyond Monero. It will run concurrently with MoneroKon in Prague, with live streams connecting both events so attendees at either location won’t miss out. No separate ticket is needed—just get your Porcfest pass. If you’re keen to sponsor, speak, host a workshop, or volunteer, reach out to MoneroTopia@protonmail.com.

The next Monero Research Lab meeting is scheduled for Wednesday, May 7, 2025, at 17:00 UTC in the #monero-research-lab Matrix/IRC channels. Rucknium is expected to chair the session, with topics including Monero’s P2P network landscape, FCMP++ transaction weight formulas, subnet deduplication tests, and OSPEAD submissions. Logs from the last meeting are available on Monero Observer.

The next Cuprate Meeting is set for Tuesday, May 6, 2025, at 18:00 UTC in the #cuprate Matrix/IRC channels. Cuprate is an effort to build an alternative Monero node implementation, and Boog900 is expected to moderate. The agenda includes project updates, planning, and open discussion. You can review the codebase here and find logs from the last meeting along with background reports on the project on the Monero Observer.

Exchanges and Merchants

According to Ape Mithrandir, Haveno-Reto is already siphoning off a major portion of Bisq’s historically dominant BTC/XMR trade flow. In March, Bisq processed 214 BTC in XMR pairs compared to Haveno’s 59 BTC. Just a month later in April, Bisq dropped to 112 BTC while Haveno surged to 140 BTC—showing a clear migration of 81 BTC in volume. While total volume across both platforms dipped slightly, Haveno-Reto’s rise highlights a strong shift among Monero-centric traders. With XMR pairs once accounting for 80% of Bisq’s revenue, the trend could have significant implications for its long-term sustainability.

XmrBazaar, a privacy-focused, peer-to-peer Monero marketplace, just rolled out a major update packed with new features and improvements. Users can now link their X accounts for profile verification, benefit from a cleaner multisig escrow experience with a new "redo decision" option, and access a how-to guide. Other highlights include enhanced dark mode, better search and listing visuals, optional reviews for canceled orders, and QR codes for RSS listings. Several bug fixes were also implemented, and upcoming features like seller bonds, listing boosts, and Signal/Session notifications are already in progress.

Monero Market has announced it will shut down operations on May 14, 2025, at 00:00 UTC, after nearly three years of running a peer-to-peer XMR trading platform. In a farewell message, the team thanked users for supporting the circular economy and cited shifting priorities: “We gave the project our all, but the effort required to keep it running no longer makes sense. We are moving on to other things.” Users are encouraged to withdraw funds and export their listing data before the shutdown.

A shopper in Kreuzlingen, Switzerland, successfully paid for organic cacao at a local SPAR supermarket using Monero. The receipt confirms the crypto payment processed via DFX Swiss.

Community Crowdfunding

Several crowdfunding proposals are awaiting community feedback before they can start accepting funds through the Community Crowdfunding System (CCS). For now, they are just proposals, but if they receive some positive feedback from the community they will be moved to a “Funding Required” stage so that they can accept Monero donations through the CCS.

Trading and Speculation

Monero (XMR) recently surged to $329, marking its highest price since August 2021. The breakout follows a strong rally that pushed XMR through key resistance levels, signaling renewed momentum and interest in private digital cash. With bulls eyeing the psychological $300 level and long-term holders watching the $517 all-time high, the recent price action has reignited excitement across the Monero community.

Network Metrics

“1 year performance - you'll never guess which one is delisted from major global exchanges and banned in several countries” - @DontTraceMeBruh

Total Monero in Circulation — 18,590,526 XMR

Monero Total Marketcap — $5,335,620,301

Coinmarketcap Ranking — #24 (last issue - #28)

XMR/USD Price — $284 (Last issue $236)

XMR/BTC Price — 0.003023 BTC

Average Transaction Fee — 0.0003 XMR ($0.072)

Monero Network Hashrate — ~4.61 Ghash/s

Monero Mining Pools Hashrate Distribution —

Entertainment

If you enjoy the newsletter and want more of this content, shout me a beer by donating some spare Monero you didn’t lose in your boating accident. I’m completely independent and rely solely on donations, with no sponsorship. A massive thank you to everyone who supports my work!

8C2xtdsCmJGhUgvMWYLayRR1wFgrjtQ2wNvzgFfrAfbjW7gatQDiNjUfFX7K5cm9UVefrVPFmxiM4jhhybsLQGpG1aeRzfD

Have we missed something?

If we've missed something important, let us know! As this is our first issue after a few months, we might have overlooked some news. Feel free to DM if there's anything you'd like included in a future issue.

Support Monero

Want to contribute to the Monero Project? Developers, marketers, event coordinators, translators, Instagram personalities, meme creators, and public speakers — whatever your skills may be, it is extremely likely there is something you can do to assist. Reach out to the Monero community on Reddit, IRC/Matrix, GitHub, Twitter, or Telegram. The official Monero website is GetMonero.org.

Past Issues

Issue 77 Issue 76 / Issue 75 / Issue 74 / Issue 73 / Issue 72 / Issue 71 / Issue 70 / Issue 69 / Issue 68 Issue 67 Issue 66 / Issue 65 / Issue 64 / Issue 63 / Issue 62 / Issue 61 / Issue 60 / Issue 59 / Issue 58 / Issue 57 / Issue 56 / Issue 55 / Issue 54 / Issue 53 / Issue 52 / Issue 51 / Issue 50 / Issue 49 / Issue 48 / Issue 47 / Issue 46 / Issue 45 / Issue 44 / Issue 43 / Issue 42 / Issue 41 / Issue 40 / Issue 39 / Issue 38 / Issue 37 / Issue 36 / Issue 35 / Issue 34 / Issue 33 / Issue 32 / Issue 31 / Issue 30 / Issue 29 / Issue 28 / Issue 27 / Issue 26 / Issue 25 / Issue 24 / Issue 23 / Issue 22 / Issue 21 / Issue 20 / Issue 19 / Issue 18 / Issue 17 / Issue 16 / Issue 15 / Issue 14 / Issue 13 / Issue 12 / Issue 11 / Issue 10 / Issue 9 / Issue 8 / Issue 7 / Issue 6 / Issue 5 / Issue 4 / Issue 3 / Issue 2 / Issue 1

Socials

If you have suggestions, corrections, or feedback, please contact me on X @johnfoss69 or Reddit u/johnfoss68.

DISCLAIMER: This publication contains opinions for informational and entertainment purposes only and does not constitute investment advice. Information may contain errors and omissions; use it solely at your own risk. The author of this publication and/or the authors of articles linked to or from this site may have financial investments that could bias their opinions, including ownership of Monero currency. No website, service, or product mentioned in the newsletter constitutes an endorsement; use them at your own risk. Always do your own research, form your own opinions, and never take risks with money or trust third parties without verifying their credibility.